Calculate gross pay from w2

Essentially a w2 generator is a tool used to calculate all your yearly wages alongside the federal and state taxes withheld from the paychecks. Add GTL imputed income from Box 12C on your W2.

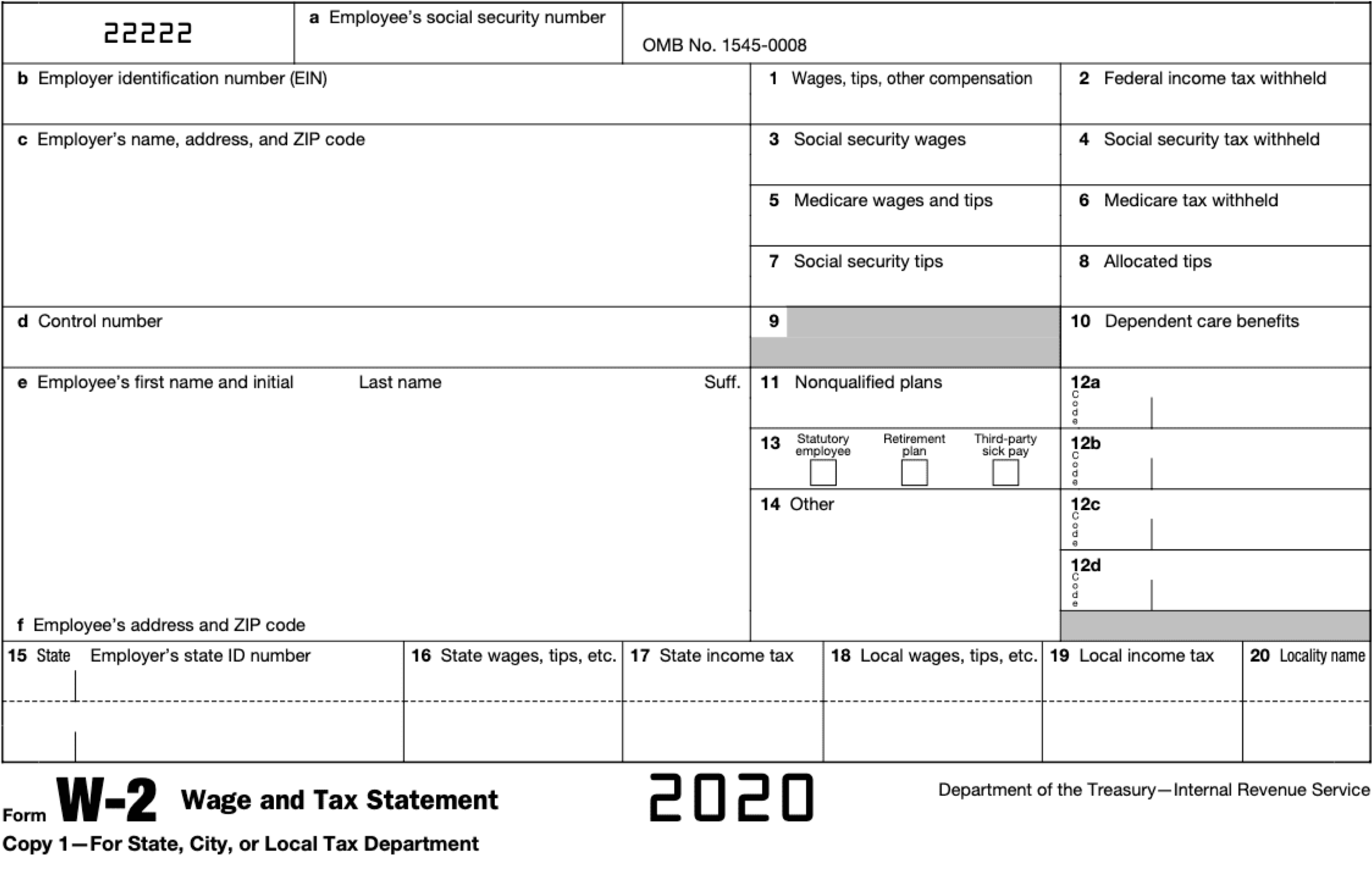

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

The free check stub maker with calculator.

. The portion of an employees earnings that are subject to. Multiply the adjusted gross biweekly wages by 26 to determine the annualized gross pay. For premium assessment and quarterly reporting gross wages include.

Wages are defined in statute RCW 50A05010 as the remuneration paid by an employer to an employee up to the Social Security cap for premium assessment. Such pretax deductions include Section 125 cafeteria plans that include health and accident insurance and dependent care and health savings accounts. If you deferred the employee portion of social security or RRTA tax under Notice 2020-65 see Reporting of employee social security and RRTA tax deferred in 2020 later for more information on how to report the deferralsAlso see Notice 2020-65 2020-38 IRB.

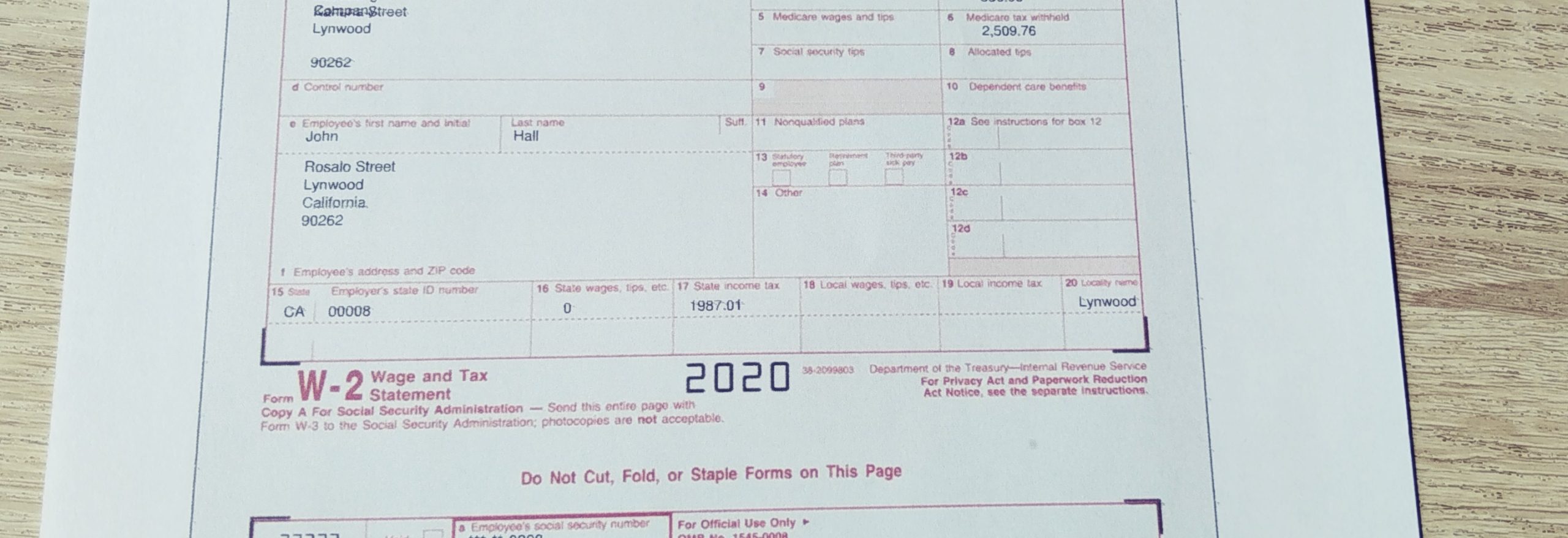

The first step of calculating your W2 wages from a paystub is finding your gross income. A wage and tax statement sums up what a W2 online is all about. Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2.

A w2 is usually a required pay stub compliment. Form W-2c reporting of employee social security tax and railroad retirement tax act RRTA deferred in 2020. Add taxable fringe benefits taxable life insurance etc to the adjusted gross biweekly wages.

This is the total amount of money youve earned without deductions or tax withholdings. Apply the annualized gross pay computed in step 4 to the. If you find that after making these adjustments to your Gross Pay YTD per your final pay stub the.

For many people this will be an hourly rate multiplied by a certain number of hours a week. The allowances are added up and form the Gross pay. To calculate your total salary obtain your taxable wages from either Box 3 or Box 5 and add the amount to your nontaxable wages and pretax deductions which are excluded from FICA taxes.

For example if your company pays an employee 4000 each month the employees gross wages for the year. A W2 form or W2 online is not just another tax document but one of the most important tax documents you need to present. The more deductions you find the less youll have to pay Use the IRSs Form 1040-ES as a worksheet to determine your estimated tax payments.

The deductions that are included in advances pay stubs are. Youll file a 1040 or 1040 SR to report your Social Security and Medicare taxes. This includes earnings in the form of hourly pay overtime wages a salary commissions bonuses and even tips and severance pay.

Gross pay does not take into account any pretax deductions or other exemptions from income. Your payroll software should let you do the following. The Best Paystubs Generate 100 Legal Pay Stubs W-2 and 1099 MISC Verified by US tax professionals Access Support 247 We make it easy.

In Paid Family and Medical Leave wages are generally referred to as gross wages without tips. Salary or hourly wages. It will take you from Gross Pay to Net pay and all in between calculations as well.

The total sum of all the above-mentioned deductions subtracted from gross pay we get net pay which is actually paid to the. Filing quarterly taxes. Calculate employee gross pay calculate employee take-home pay after income taxes FICA and deductions for things like health insurance retirement and child support pay employees by printing out checks are making a direct deposit fill out and submit required paperwork for federal state and.

Organize the results in. Begin with the Gross Pay YTD year-to-date and make the following adjustments if applicable. Then calculate the YTD year to date for the duration of the time you were employed.

First calculate your adjusted gross income from self-employment for the year.

Irs W 2 Form Pdffiller W2 Forms Tax Forms Irs

Your W 2 Employees Help Center Home

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Calculate Agi From W 2 Tax Prep Checklist Tax Prep Tax Refund

Form W 2 Explained William Mary

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

How To Calculate W2 Wages From Paystub Paystub Direct

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Your W 2 Controller S Office

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

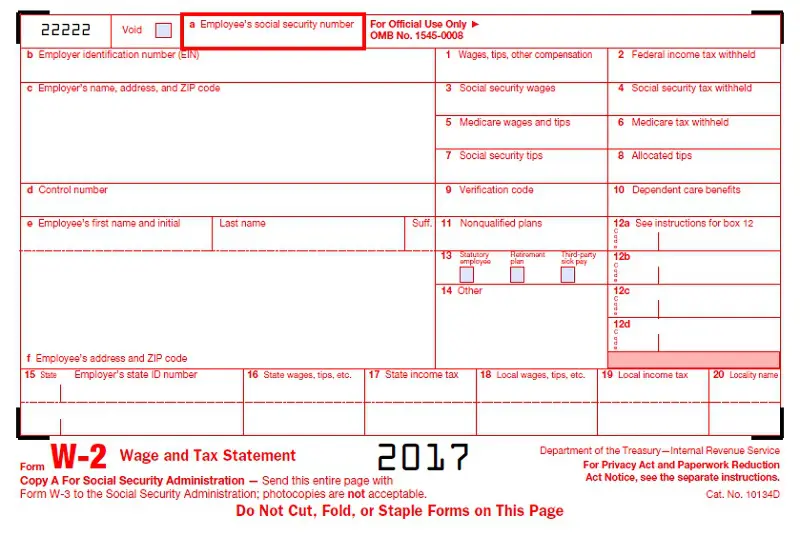

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog